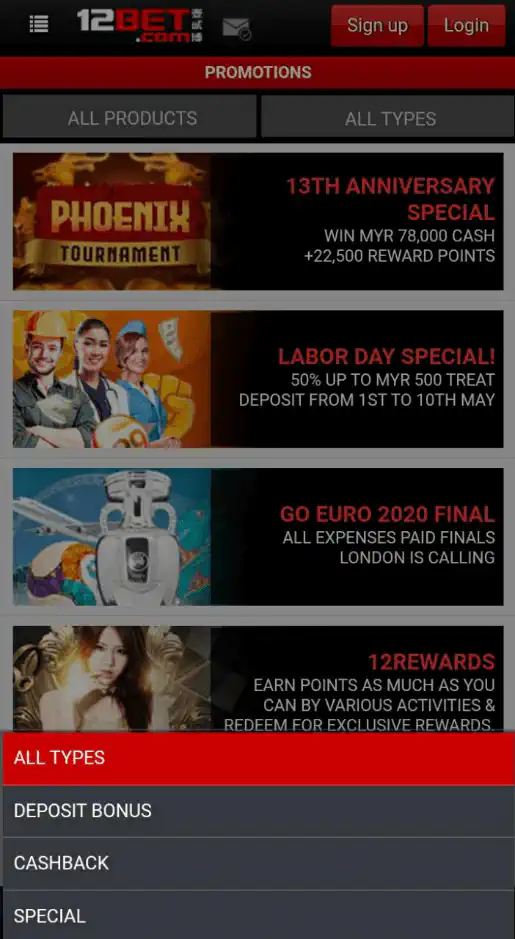

12bet Promotions and Bonuses

12Bet is a leading online sports betting platform that offers a wide range of promotions and bonuses to appeal to all types of bettors. Whether you’re a seasoned gambler or just getting started, 12Bet has something to offer.

One of the most popular promotions offered by 12Bet is the welcome bonus. This bonus is available to new customers who sign up for an account and make their first deposit. The bonus amount varies depending on the country and currency, but it is a great way to start your betting experience with some extra funds.

Another great promotion offered by 12Bet is the reload bonus. This bonus is available to existing customers who make a deposit into their account. The bonus amount varies depending on the amount of the deposit, but it is a great way to boost your betting balance.

For those who are looking to maximize their winnings, 12Bet also offers a cashback bonus. This bonus is available to customers who have experienced a losing streak and is a percentage of the amount lost. It’s a great way to recoup some of your losses and keep betting.

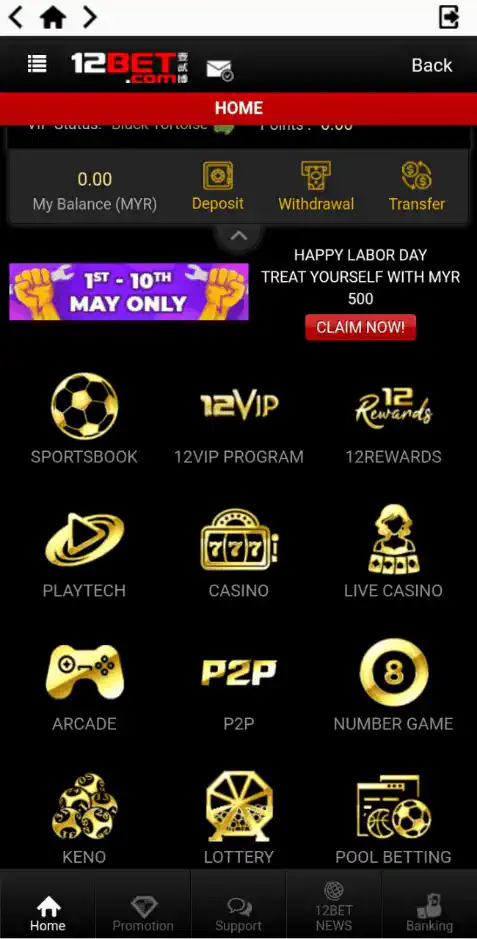

For loyal customers, 12Bet also offers a VIP program. As a VIP, you’ll receive special treatment, including exclusive bonuses and promotions, a personal account manager, and invitations to VIP events.

It’s important to note that each promotion and bonus offered by 12Bet comes with terms and conditions. These terms and conditions include details such as the minimum deposit and rollover requirements, as well as any restrictions on the types of bets that can be placed. It’s important to read and understand these terms and conditions before taking advantage of any promotions or bonuses to ensure that they align with your betting style and budget.

In conclusion, 12Bet is one of the most popular sports betting companies in the world, and for good reason! They offer a wide range of promotions and bonuses that are sure to appeal to all types of bettors. It’s important to read and understand the terms and conditions associated with each offer before taking advantage of them to ensure that they align with your betting style and budget.

Everything You Need to Know About 12Bet

One of the most popular promotions offered by 12Bet is the welcome bonus. This bonus is available to new customers who sign up for an account and make their first deposit. The bonus amount varies depending on the country and currency, but it is a great way to start your betting experience with some extra funds.

Another great promotion offered by 12Bet is the reload bonus. This bonus is available to existing customers who make a deposit into their account. The bonus amount varies depending on the amount of the deposit, but it is a great way to boost your betting balance.

For those looking to maximize their winnings, 12Bet also offers a cashback bonus. This bonus is available to customers who have experienced a losing streak and is a percentage of the amount lost. It’s a great way to recoup some of your losses and keep betting.

For loyal customers, 12Bet also offers a VIP program. As a VIP, you’ll receive special treatment, including exclusive bonuses and promotions, a personal account manager, and invitations to VIP events.

In addition to these promotions, 12Bet also offers a variety of other bonuses and promotions, such as refer-a-friend bonuses, special event promotions, and more. These promotions are updated regularly, so it’s a good idea to check back often to see what’s new.

It’s important to note that each promotion and bonus offered by 12Bet comes with terms and conditions. These terms and conditions include details such as the minimum deposit and rollover requirements, as well as any restrictions on the types of bets that can be placed. It’s important to read and understand these terms and conditions before taking advantage of any promotions or bonuses to ensure that they align with your betting style and budget.

In conclusion, 12Bet is a leading online sportsbook and casino operator that offers a wide range of betting opportunities for both recreational and professional bettors. The company is licensed and regulated and has a solid reputation as a fair and reputable operator. They offer a variety of sports, casino games, and attractive promotions and bonuses that are sure to appeal to all customers. It’s important to read and understand the terms and conditions associated with each offer before taking advantage of them to ensure that they align with your betting style and budget.

Attractive Welcome and Bonus Offers

In addition to the Welcome Bonus, 12Bet also offers a Deposit Match Bonus for new customers. This bonus is based on the amount of your first deposit and can range from 50% to 100% of the deposit amount. This bonus can be a great way to boost your betting balance and increase your chances of winning.

12Bet also offers a Free Bet Bonus for new customers. This bonus can be used to place a free bet on any sport or event of your choice. The bonus amount varies depending on the event or sport, but it’s a great way to try out 12Bet’s betting options without risking any of your own money.

For existing customers, 12Bet offers Reload Bonuses. This bonus is available on every deposit and it can vary depending on the amount of the deposit. This bonus can be a great way to boost your betting balance and increase your chances of winning.

12Bet also offers a Cashback Bonus for customers who have experienced a losing streak. This bonus is a percentage of the amount lost and it’s a great way to recoup some of your losses and keep betting.

For loyal customers, 12Bet offers a VIP program. As a VIP, you’ll receive special treatment, including exclusive bonuses and promotions, a personal account manager, and invitations to VIP events.

It’s important to note that each bonus and promotion offered by 12Bet comes with terms and conditions. These terms and conditions include details such as the minimum deposit and rollover requirements, as well as any restrictions on the types of bets that can be placed. It’s important to read and understand these terms and conditions before taking advantage of any bonuses or promotions to ensure that they align with your betting style and budget.

In conclusion, 12Bet offers a variety of bonuses and promotions that can appeal to all types of bettors, from new customers to existing ones and VIPs. From welcome bonuses, deposit match bonuses, free bets, reload bonuses, cashback and more, 12Bet has something for everyone. Be sure to read and understand the terms and conditions associated with each offer before taking advantage of them to ensure that they align with your betting style and budget.

12bet bonus terms & conditions

It’s important to note that the bonus can only be used to place bets on sports events and cannot be used in the casino or live casino sections of the site.

Certain types of bets and events may also be excluded from the bonus, such as system bets and special markets. It’s important to check the terms and conditions for a full list of excluded bets and events.

In addition, players should be aware that there may be maximum bet limits in place while using the bonus. These limits may vary depending on the event or sport, so it’s important to check the terms and conditions for specific details.

It’s also worth noting that 12bet reserves the right to modify or cancel the bonus at any time. This can be due to changes in the market or regulatory requirements.

It’s important to read the 12bet bonus terms and conditions thoroughly before availing of the offer, to make sure that the bonus aligns with your betting style and budget. By understanding the terms and conditions, you can make the most of the bonus and increase your chances of winning.

There are a few other 12bet bonus terms & conditions that you should be aware of. These include the following:

- You must be a resident of India to avail of this offer

- This offer is only available to new customers

- The minimum deposit is INR 1500

- The maximum bonus amount is INR 21,000

- The wagering requirement is 12x the deposit and bonus amount

- The bonus expires after 30 days

Bonus 12Bet promotion to welcome new members

It’s important to note that the deposit match bonus and free bets have different wagering requirements and terms and conditions. The deposit match bonus must be wagered 15 times on specific sports, while the free bets have no time frame and can be wagered on any sports with odds of at least 10 times.

In addition to the Welcome Bonus, 12Bet also offers a number of other promotions and bonuses for existing customers. These include reload bonuses, cashback bonuses, and referral bonuses. It’s important to check the terms and conditions for each promotion to ensure that they align with your betting style and budget.

It’s also worth noting that 12Bet reserves the right to modify or cancel the bonus at any time. This can be due to changes in the market or regulatory requirements.

Overall, the 12Bet Welcome Bonus is a great way for new members to start their betting experience with some extra funds and free bets. By understanding the terms and conditions and taking advantage of the promotions and bonuses offered, you can increase your chances of winning and make the most of your 12Bet experience.

VIP rewards every week

As a 12Bet VIP, you will have access to a wide range of exclusive benefits, including:

- Higher deposit and withdrawal limits

- Faster withdrawal times

- Personalized customer service and support

- Exclusive promotions and bonuses

- Invitations to VIP events and experiences

The VIP program is designed to reward and recognize the most dedicated and active customers. The more you bet and the more points you earn, the higher up the VIP ladder you will climb. This means that the benefits will increase as you move up the levels.

It’s important to note that the VIP program is subject to change and 12Bet reserves the right to modify or cancel the program at any time. This can be due to changes in the market or regulatory requirements.

In addition to the VIP program, 12Bet also offers a wide range of promotions and bonuses for all customers. These include welcome bonuses, reload bonuses, cashback bonuses, and more. By taking advantage of these offers, you can increase your chances of winning and make the most of your 12Bet experience.

Overall, the 12Bet VIP program is a great way for dedicated and active customers to get more value out of their account. With exclusive benefits and rewards, you can enjoy a more personalized and enjoyable betting experience.

What are the Wagering requirements for the 12bet Bonus in India?

Once you have met the wagering requirements, your bonus will be credited to your account. This means that you will have extra money to play with, which increases your chances of winning big.

However, it’s important to note that the 12Bet bonus code is subject to change and availability. This means that the bonus code may not always be available, and the terms and conditions of the bonus may change from time to time.

It’s also worth mentioning that the 12Bet bonus code is not the only way to claim bonuses and promotions on the site. They also offer a wide range of other promotions, such as welcome bonuses, reload bonuses, and cashback bonuses. These promotions are available to all customers, regardless of whether or not they have a bonus code.

To ensure that you are taking full advantage of all the bonuses and promotions offered by 12Bet, it’s important to keep checking their website and promotions page. You can also sign up for their newsletter to stay informed of new promotions and bonuses.

In summary, the 12Bet bonus code is a great way to claim extra bonuses and increase your chances of winning big. However, it’s important to check the terms and conditions of the bonus and keep an eye out for other promotions. With a little bit of research and a bit of luck, you can make the most of your 12Bet experience and potentially win big.

Benefits of 12bet bonuses

Another benefit of 12bet bonuses is that they increase your chances of winning. With extra money to play with, you have more opportunities to place bets and potentially win big. Additionally, many of the bonuses offered by 12bet, such as the welcome bonus and deposit match bonus, are automatically credited to your account after you make a deposit. This makes it easy for you to take advantage of the bonuses right away.

Furthermore, 12bet bonuses can also help you to build your bankroll. This is especially true for the deposit match bonuses, which add extra money to your account. With a larger bankroll, you can place bigger bets and potentially win more money.

Another benefit of 12bet bonuses is that they can help you to meet wagering requirements. Many bonuses come with specific wagering requirements, which must be met before you can withdraw any winnings. By using bonuses, you can potentially meet these requirements faster, allowing you to withdraw your winnings sooner.

Lastly, 12bet offers a VIP program for loyal customers, where members receive special treatment, including exclusive bonuses and promotions, personal account manager, and invitations to VIP events. This is a great way to reward customers for their loyalty.

In conclusion, 12bet bonuses offer many benefits, including the chance to win more money, build your bankroll, meet wagering requirements, and receive special treatment as a VIP member. These bonuses can help to increase your chances of winning and make your 12bet experience more enjoyable.

How to wager the bonus?

It’s also important to note that certain types of bets and games may not count towards the wagering requirement. Be sure to read the terms and conditions of the bonus carefully to understand which bets and games are eligible. Additionally, some bonuses may have expiration dates, so make sure you use them before they expire.

Another important aspect to consider with 12bet bonuses is the maximum and minimum withdrawal limits. These limits can vary depending on the bonus and can affect the amount of winnings you can withdraw. So, it is crucial to check these limits before claiming a bonus, to make sure it suits your needs and expectations.

In conclusion, 12bet bonuses can be a great way to increase your chances of winning and get more value out of your account, but make sure to read the terms and conditions carefully and understand the wagering requirements, expiration dates, and withdrawal limits.

Some note when enjoying promotions at the 12bet house

Another thing to keep in mind is that 12Bet may have certain restrictions on the types of bets that qualify for a bonus. For example, certain promotions may only be valid for bets placed on sports with certain odds or on certain markets. It’s also important to be aware of any minimum deposit or minimum bet requirements for each bonus.

Additionally, certain bonuses may have time restrictions, such as a limited period for claiming or using the bonus. So, it’s important to take note of these details before claiming a bonus and ensure that you can meet the requirements before the expiration date.

Overall, 12Bet offers a wide range of bonuses and promotions that can help you get more value out of your bets. However, it’s important to read and understand the terms and conditions of each bonus before claiming it to ensure that you are fully aware of the requirements and restrictions.

FAQs on 12Bet’s Bonuses

Q: What bonuses does 12Bet offer?

A: 12Bet offers a variety of bonuses for their customers, including welcome bonuses, reload bonuses, and referral bonuses.

Q: How do I qualify for a welcome bonus?

A: To qualify for a welcome bonus, you must be a new customer and make a deposit into your account. Specific terms and conditions may vary, so be sure to check the details on the 12Bet website.

Q: Can I claim multiple bonuses at once?

A: No, you can only claim one bonus at a time.

Q: Are there any restrictions on withdrawing bonus funds?

A: Yes, there may be restrictions on withdrawing bonus funds, such as a minimum rollover requirement. Be sure to read the terms and conditions carefully before claiming a bonus to ensure you understand the restrictions.

Q: Can I withdraw my bonus funds?

A: Yes, you can withdraw your bonus funds once you have met the rollover requirement.

Q: How do I know if I have met the rollover requirement?

A: You can check your account balance to see if you have met the rollover requirement. If you have any questions or concerns, you can contact customer support for assistance.

Q: Are there any special promotions or bonuses for mobile users?

A: 12Bet may occasionally offer special promotions or bonuses for mobile users. Be sure to check the website or sign up for email updates to stay informed about current promotions.

Q: Is there a limit to how much I can earn in bonuses?

A: Yes, there is a limit to how much you can earn in bonuses. This information can be found on the 12Bet website under the terms and conditions for each bonus.

Q: Are there any specific requirements to claim a referral bonus?

A: To claim a referral bonus, you must refer a friend to 12Bet and they must create an account and make a qualifying deposit. Specific terms and conditions may vary, so be sure to check the details on the 12Bet website.

Q: Are there any expiration dates for bonuses?

A: Yes, some bonuses may have expiration dates and must be claimed within a certain timeframe. Be sure to check the terms and conditions for each bonus to see if there is an expiration date.

Q: Are there any geographic restrictions for bonuses?

A: Yes, some bonuses may only be available to customers in certain countries or regions. Be sure to check the terms and conditions for each bonus to see if there are any geographic restrictions.

Q: Can I cancel a bonus once I have claimed it?

A: It depends on the specific bonus and the terms and conditions of that bonus. Some bonuses may be cancelable while others may not. Be sure to check the details of each bonus before claiming it to see if it can be cancelled.

Q: Is there a customer support team available to help with bonus-related issues?

A: Yes, 12Bet has a customer support team available to assist with any questions or issues related to bonuses. You can contact them through live chat, email, or telephone for help.